Brits without savings issued ‘unexpected’ £250 warning | Personal Finance | Finance

Brits are being issued a warning for savings (Image: Getty)

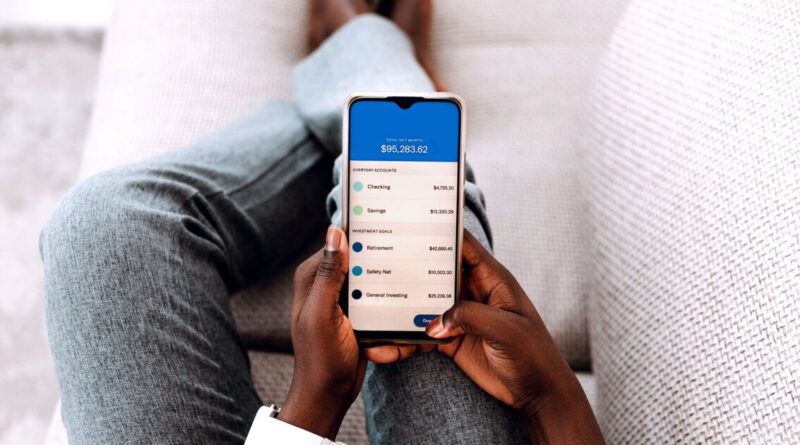

Brits have been issued an “unexpected” £250 warning after new research revealed millions would struggle to cope with even a modest financial shock.

One in five UK adults said they would need to take on debt to cover an unexpected £250 expense, while a further 5% admit they would not be able to pay the cost at all, according to the latest Retirement Voice report from Standard Life. The findings highlight the fragile state of household finances as many continue to grapple with rising living costs. Among those who would need to borrow to meet a £250 emergency bill, the most common option would be a credit card, used by 13%. Others said they would turn to family or friends (4%), take out a personal loan (1%) or even rely on a payday loan (1%), despite the high interest rates often attached to short-term borrowing.

READ MORE: Martin Lewis tells anyone with mobile ‘text this four-letter word now’

READ MORE: Expert says how you answer ‘shop question’ can impact your PIP claim

One in five UK adults say they would need to take on debt to cover an unexpected £250 expense (Image: Getty)

The warning comes at a time when pressure on household budgets remains intense. Almost a quarter of people surveyed (23%) said they are finding it difficult to live on their current income, while nearly one in three cited inflation and rising prices as a key concern. Household energy costs also continue to weigh heavily, worrying 28% of respondents.

January is traditionally a tough month financially, following festive spending and with bills often peaking in winter.

For many households already stretched, the research paints a stark picture of how little financial resilience some have when faced with an unexpected cost.

Despite this, there are signs that attitudes may be shifting. A quarter of UK adults (25%) said building a rainy-day fund to cover unexpected expenses is a financial priority for them over the next year, suggesting growing awareness of the need for a safety net.

Mike Ambery, retirement savings director at Standard Life, part of Phoenix Group, said the findings were concerning but not surprising.

“As we head into 2026, pressure on household budgets remains very real. It’s worrying that so many people would struggle to cover a relatively small, unexpected cost without borrowing,” he said.

“With so many people already finding it hard to stay on top of their monthly finances, building savings can feel even more difficult.”

He added that even small changes can make a meaningful difference over time. “It’s encouraging to see people prioritising rainy-day savings. Small, practical steps can help people feel more financially resilient while also planning for the future.”

Standard Life shared a series of practical tips to help households build greater financial security.

These include prioritising essential bills such as rent, mortgage payments and utilities, and keeping a closer eye on spending using banking apps or simple budgeting tools to identify areas where money could be saved.

Reviewing subscriptions and direct debits is another key step. Standard Life analysis suggests the average Brit wastes £39 a month on unused subscriptions, money that could instead be redirected into savings.

Setting up automatic transfers into a savings account as soon as wages are paid can also help people save consistently without feeling the pinch.

Experts also advise building an emergency fund gradually, aiming for three to six months’ worth of essential living costs where possible, and being cautious with borrowing by exploring low-interest options first. For those struggling, free support services such as StepChange and Citizens Advice are available.

With many households living close to the edge, the £250 warning serves as a reminder of how vulnerable finances can be — and how even small steps now could help soften the impact of the next unexpected bill.