April bill increases could sabotage your credit cards and mortgages | Personal Finance | Finance

Findings from CredAbility indicate that 24% of UK adults, around 12.2 million people, have missed at least one payment in the last year.

Come April, energy price caps are set to soar to an average of £1,849 annually, while various other outgoings, including water, broadband and vehicle tax rates, are poised for an increase too.

As households find it increasingly difficult to meet all their bills, specialists are warning that some could jeopardise their future financial stability.

CredAbility’s Personal Finance Expert Aaron Peake cautioned: “A single missed payment can lower your credit score, making it more expensive to borrow money and harder to get approved for credit in the future.”

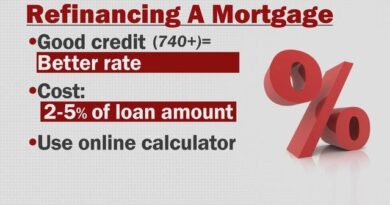

This could significantly influence the terms you get for credit cards, mortgages, and loans, or it could block access to such services entirely.

The expert particularly highlighted the dangers resorting to “riskier, unregulated credit products” such as payday loans and Buy Now, Pay Later schemes.

Having a suboptimal credit score usually results in paying a higher interest rate.

Experts believe consumers with low credit scores might end up paying an additional £256,630 throughout their lives due to this, exacerbating their cost-of-living woes.

However, there are ways to safeguard your credit score against this, Aaron outlined four steps to take in the coming month:

- Don’t cancel direct debits

- Explore financial support

- Check for mistakes on your credit report

- Seek free debt advice

If you’re considering cancelling direct debits for essentials like energy to cut down on costs, the experts recommended reaching out to your providers for repayment plans first.

Assistance is available for qualifying households through suppliers such as energy providers, local councils or the government.

It’s helpful to know what your current credit score is and if correcting any issues in your credit report could potentially give it a slight boost.

Common errors on a credit report include incorrect credit limit listings for your credit cards, closed accounts still listed as open on your report, or inaccurate information, like a debt attributed to someone with a similar name appearing on your report.

There are cost-free methods to enhance your credit score, such as registering on the electoral roll at your current address.

Too many credit applications within a short timeframe can also begin to impact your score, so it’s advised to use an eligibility checker before applying.

Websites like CredAbility or ClearScore enable you to check your credit score and report.

If you’re struggling to identify clear ways to enhance your credit score or shield your finances from the impending cost of living increases, there are several free services on hand to assist, including Citizens Advice, the National Debtline and StepChange.