Martin Lewis explains ‘crucial’ detail on winter fuel payment return | Personal Finance | Finance

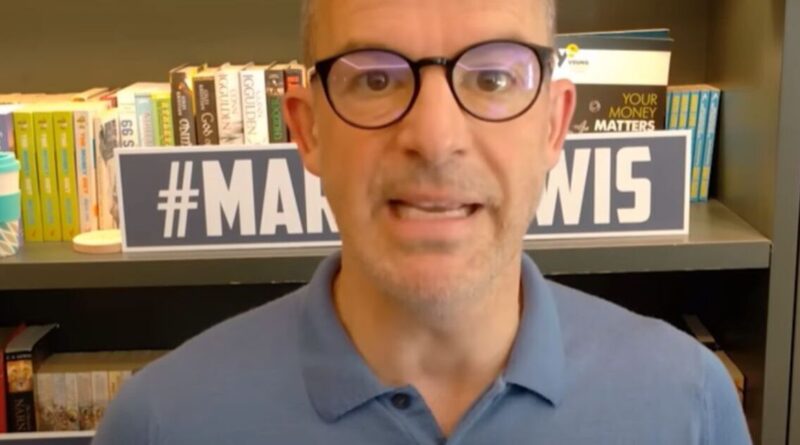

Money Saving Expert Martin Lewis has welcomed the Government’s decision to reinstate the winter fuel payment for millions of state pensioners in England and Wales this coming winter, after last year’s controversial means-testing. In his latest video, Mr Lewis explained how the new system will work, who will benefit, and “crucial” details to be aware of.

Posting on X, Mr Lewis said: “We’ve far more detail in on how it works. Pls share with anyone with questions.” The winter fuel payment, which provides £200 to pensioner households with members under 80 and £300 to those with members over 80, will be paid automatically to all state pensioner households this winter. This marks a reversal of last year’s policy, which restricted payments to those on Pension Credit or other means-tested benefits, excluding millions from support during a period of high energy costs.

However, one key change is that pensioners with an individual income above £35,000 will still receive the payment, but it will be reclaimed through the tax system, either via PAYE or self-assessment.

Mr Lewis stressed that this process will not require anyone to register with HMRC or file a tax return unless they already do so for other reasons, addressing concerns about unnecessary complexity.

Another “crucial” detail is that although the payment is made per household, Mr Lewis said the tax clawback is applied individually.

For example, in a household receiving £300 (for two pensioners over 80), if one partner earns over £35,000, only their £150 share will be reclaimed through tax, while the other partner keeps their share if their income is below the threshold.

If both partners are under the limit, both keep their payments; if both are above, both have their shares reclaimed.

Mr Lewis described the new system as a “very big improvement” over last winter’s arrangements, highlighting two main reasons.

First, the income threshold has been raised from just over £11,000 to £35,000, which should see three out of four state pensioners receive the payment, according to Government estimates. Second, the payment is no longer linked to Pension Credit – a benefit that is significantly underclaimed, ensuring that vulnerable pensioners who might not apply for extra help will now receive support automatically.

He also addressed concerns about high-income pensioners receiving the benefit, noting that those who do not want the payment can opt out or will have it reclaimed through the tax system. However, praising the rules, he said: “Far more pensioners who were struggling with still-high energy bills will get this payment.”

The Department for Work and Pensions (DWP) is expected to publish full details, including payment dates and any further eligibility criteria, by the end of June.