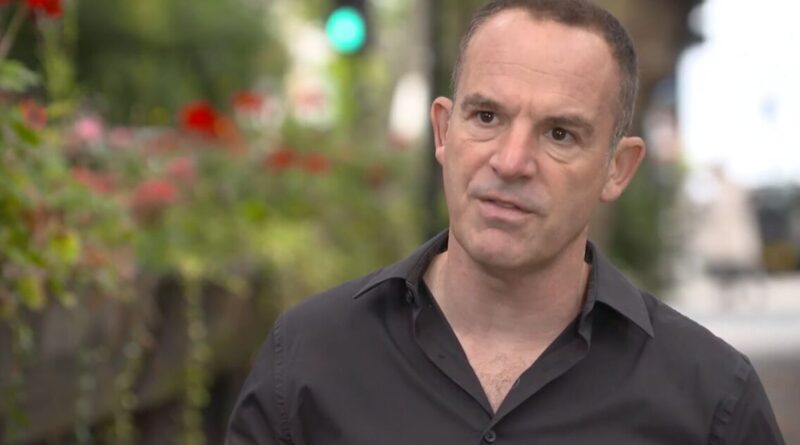

Martin Lewis explains little known ISA rule change with £10,000 option | Personal Finance | Finance

Martin Lewis has highlighted a little-known change to ISA rules which could benefit savers. Speaking on his BBC Podcast with host Adrian Chiles, Mr Lewis said many didn’t realise the rules have been changed – meaning previous restrictions on accounts didn’t apply.

Mr Lewis was answering a question concerning the number of ISAs a person could take out in one financial year.

But now he said that rule has changed – meaning people can take advantage of offers and split up their investments up, for example into £10,000, £5,000 and £5,000 segments to make the most of deals.

He said: “Ever since ISAs were set up there’s been a limit on the amount of money you can have in and you’ve been able to open a cash ISA and a stocks and shares ISA in the same year.

“But you’ve only been able to open one of each type. But from April 6 2024 the rules were changed and the restrictions on subscribing to one ISA of each type in a year was removed,

“You may now open as many different ISAs of one type, for example a cash ISA you can have a fix and two easy access cash ISAs all of which you’ve opened and put new money into within one tax year .

A saver might want to open multiple easy access cash ISAs to potentially benefit from better interest rates offered by different providers or to manage savings for different goals.

A saver can open and fund multiple cash ISAs in the same tax year, as long as the person don’t exceed your annual ISA allowance of £20,000.

This would mean that although the total a person is allowed to invest in new ISA cash in that financial year is £20,000 they can split it up between accounts. For example they might want to take advantage of higher Interest Rates where different providers could offer varying interest rates on their easy access cash ISAs.

By comparing and potentially using multiple accounts, the person might be able to maximize your interest earnings.

Accountancy experts AJ Bell say: “Each tax year, you can split your annual ISA allowance of £20,000 between the all different ISAs you’re eligible for. The annual ISA allowance is for all your ISA savings combined and not per individual ISA account. So, you can pay into as many of your ISAs as you want to, as long as you stay within your overall allowance.

“Just remember – a Lifetime ISA has its own limit of £4,000, which sits within your overall allowance. You can even pay into multiple Cash, Stocks and shares or Innovative Finance ISAs in the same tax year, if you stay within the overall ISA allowance. There are still restrictions on multiple Lifetime ISAs or Junior ISAs.”

Listen to the full podcast here.