Martin Lewis explains what interest rate cut means for mortgages | Personal Finance | Finance

News that the Bank of England has cut the base interest rate to 4.5% might seem like good news – but what exactly does it mean for your wallet?

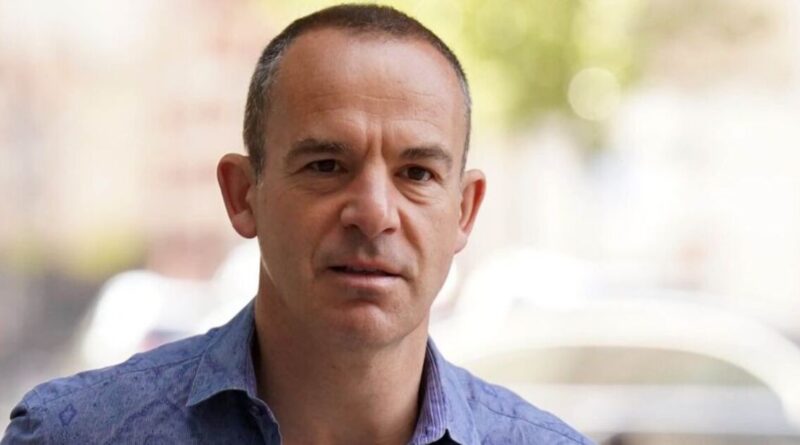

Money Saving Expert founder Martin Lewis has offered a quick oversight of how the cut will impact their mortgages, savings, cards and loans.

Policymakers voted to bring the base interest rate to its lowest level in over 18 months on Thursday – and Mr Lewis said it is expected to drop further to around 3.75% by the end of 2025.

The base rate informs how expensive it is to take out a mortgage or loan and influences the interest rates offered by banks on savings accounts.

The man behind MoneySavingExpert.com said people currently paying fixed mortgages would see “no change until [the] fix ends” but that those on tracker rates will see rates drop 0.25% points.

He added that the changes would “take up to a month to come in” but could be equivalent to “£15 lower repayments per month per £100,000 of mortgage“.

Meanwhile, those with variable rate savings accounts could also see a drop of 0.25% in between two and four weeks.

Mr Lewis added: “There’s a lot of competition out there in the cash ISA market at the moment, [however], so I think the very top rates could stay at or above 5%.”

The financial expert said fixed-rate savings accounts would have likely “already factored in some of this cut” but could “shave [it] down further”. He added: “If you want to fix your savings, [the] best bet is [to] do it today.”

While credit card rates would be “mostly unaffected” by the cut because “they’re already so high above the base rate”, with average APRs around 24.9%, Mr Lewis said there was a chance that longer 0% deals would be launched by providers.

Similarly, those already paying back existing loans would be unlikely to see any impact due to already being on fixed rates.

He said: “New loans are [also] set based more on interest rate forecasts than base rate moves.”

But those thinking about taking out a new loan in the near future could benefit from “the cheapest new loan rates” being shaved down “very marginally” in the wake of today’s news.

Despite the interest rate cut appearing to be a good news story, and prompting Prime Minister Sir Keir Starmer to declare that it would put “more money in [people’s] pockets”, the Bank of England didn’t paint a rosy overall picture of the UK economy.

The Bank halved its 2025 growth forecast for the country and predicted a surge in inflation, with more people out of work following the higher taxes and wage increases announced in the October Budget.