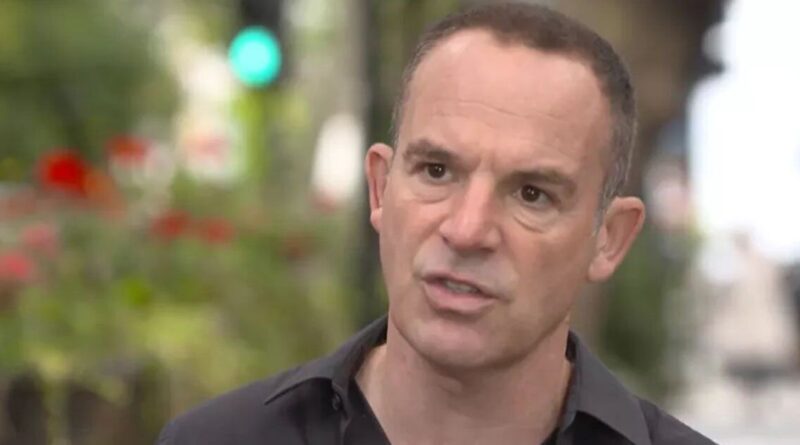

Martin Lewis tip helps woman with health issues save £600 on insurance | Personal Finance | Finance

A woman has saved almost £600 on travel insurance after following a simple Martin Lewis tip. The woman followed instructions on obtaining travel insurance when you have specific health conditions and made the huge saving as a result.

She emailed the Money Saving Expert website and said: “I recently needed travel insurance to cover my health issues while visiting the USA. My usual company quoted me more than £900 for a single-trip policy. Thanks to your guide on travel insurance for pre-existing conditions, I was able to get cover with an alternative provider for almost £600 less. Thank you so much!”

The three-step guide helped those struggling to obtain travel insurance due to a range of conditions, setting out what people need to declare, what they should know if they have pre-existing conditions and how to find the right type of cover for their needs.

The experts advise those travelling with serious health conditions to first obtain quotes from their standard “top-pick policies”.

They said: “Each insurer will have its own list of conditions it deems as more serious, which means you might have to pay a premium or get specialist cover.

“If that’s the case, or you know you have a severe condition, it may be best to skip to step 2.”

Step two advises those with serious conditions to try specialist medical sites to find the best cover for their needs.

They added: “To cover more serious conditions, such as heart conditions, certain joint conditions or cancer, you’ll likely need to try specialist medical insurers (often you won’t see these on normal comparison sites).

“A good starting point – to benchmark a price – would be to get a quote online from Medical Travel Compared*. This specialist comparison site works with a wide range of insurers. It’s also worth checking Payingtoomuch as well.”

The experts then advised that if the first two steps do not work for travellers, they should seek to contact a broker to help put them in contact with firms that cover non-standard medical conditions, or non-standard trips.

They said: “To find one, see the British Insurance Brokers’ Association website. Always double-check the level of cover offered before taking out a policy, and ask the broker to explain if you’re not sure about anything.”