Martin Lewis warning over little-known student debt change | Personal Finance | Finance

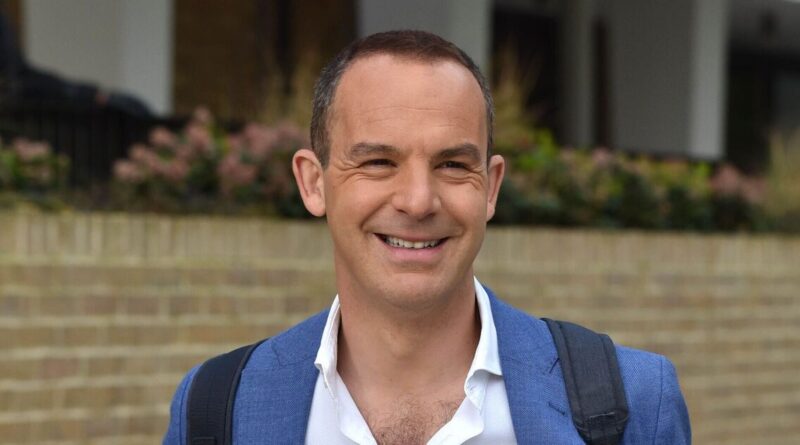

Martin Lewis (Image: Getty)

Martin Lewis has dished out his latest pearls of wisdom on student finance as he warned of a little-known rule change that will see many pay for far longer.

The cost of university education and the subsequent student loan repayments can be a daunting prospect for many potential students. Yet, in the most recent instalment of his podcast, Martin shed light on several crucial perspectives that could help demystify student loans and aid in making a more informed choice.

Student loans are distinct from other types of loans, and Martin emphasised that they should not be viewed as conventional debt. Instead, they represent a different kind of financial obligation – but an ‘under the radar’ change last year may see people pay back for much longer.

On the Martin Lewis Podcast, he elaborated: “I’m gonna talk through the five things I think everybody needs to know about student finance. Now it is worth noting I’m going to talk about the situation in England, for the moment…because there are very serious devolution differences in the way student finance works.

“I also need to state, I’m going to explain to you the system for people who started university after 2023 in England. There was a rather under-the-radar seismic change, which unfortunately in practical terms will have substantially increased the cost many people pay to go to university in England. But not by increasing tuition fees and not by increasing debt.”

The ‘real student loan price tag’

Martin explained: “The student loan price tag is often £60,000 or more which adds up, tuition fees are up to £9,250 a year, times that by three because you’re on a three-year course, add in the maintenance loan and 60 grand seems normal. But you don’t pay any of that, the student loan company pays tuition fees for you and it gives a maintenance loan…and actually that £60,000 price tag bears very little resemblance to what you pay.

“Some people will pay far far less, some will pay nothing at all, some will pay far far more. And it’s really important to understand the mechanics of what you pay.

“Now you start repaying university in the April after you leave, that’s when you’re first eligible to start to repay. For you on this, what are called ‘plan five loans’ – you will only repay if you earn over £25,000 a year.

“If you earn less, you do not pay anything back and you will repay 9 per cent of everything you earn above that amount. So earn more, you pay more, earn less, you pay less.

“The loan, regardless of how much you paid unless you cleared it all, wipes after 40 years – it’s gone, you do not owe it anymore, you’re not obligated to pay any more even if you hadn’t paid a penny, after 40 years you would not have to pay any more money back.

“With student loans, while they’re called a loan, there’s no worry of debt collectors as it’s repaid via the payroll which is what happens when you’re working, you go to work, you’re paid, the money, just like your tax comes off your salary before it comes in your pay packet the same happens with student loans. And for those who are self-employed, they pay through the self-assessment system and the debt, by the way, doesn’t go on your credit file.”

Your repayments are based solely on what you earn

He added: “The amount you borrow is mostly irrelevant day-to-day. This works more like a tax..because you pay 9% of everything you earn above £25,000.”

He provided the following example: “You repay 9 per cent of everything you earn above £25,000. If you owed 20 grand…let’s imagine you owe £20,000, that’s the level of your student debt and you’re earning £26,000.”

“You repay 9% of everything earned above £25,000.”

In this example you would only pay 9% of £1,000, equating to only £90. In the case that your debt is £50,000 but you earn £26,000 you would still only owe £90 as it’s based on your earnings, not what you owe.

He also used a more drastic example where you owe £1 million on your student finance. You would still owe £90 a year if you earned £26,000.

If you earned £30,000, you would instead repay £900 a year.

The difference what you owe makes to clearing the debt

Martin pointed out that your income level will determine whether you can clear your debt within 40 years. He said: “It doesn’t dictate how much you pay a year, it doesn’t dictate your annual cash flow, it doesn’t dictate how much you’re going to struggle to pay or not – you’re going to pay 9% of everything above 25 grand.”

He explained the significant changes in the 2023 English student finance system: “Previously, only 23% of graduates were likely to clear in full within the 30 years it wiped. Now you’ve got 40 years you have to pay and you start repaying at a lower level of income at £25,000 instead of the other at £27,295 – 52% are likely to clear in full. So in reality though, the vast majority of people, unless you are a high high earner are going to be repaying this student loan for most of the 40 years.”

Student loan is more like a tax than a debt

He emphasised that student loan repayments would feel more like an additional tax than a debt.

He further added: “You are going to repay 9% more tax…currently everybody is allowed to earn £12,570 a year and they don’t pay tax on it. From £12,571 to £25,000 you don’t repay the student loan, you repay 2% of all earnings between that, that’s the same for uni-goers and non-uni-goers. From £25,000 to £50,270 the tax rate is 20% for those who haven’t gone to uni.

“If we treat the student loan as a form of tax, what is the effective tax rate for somebody earning over £25,000 but less than £50,000 if it’s 20% for everyone else? ” He questioned. “If you don’t go to uni it’s 29%, if you go to uni it’s effectively going to be 29%, if you earn over £50,271, don’t go to uni it’s 40%, do go to uni it’s 49%.

“And if you’re lucky enough to earn over £125,140, don’t go to uni, it’s 45%, do go to uni it’s 54% but if you’re earning that much you’ll likely pay off the loan relatively quickly so you won’t be paying the higher rate for longer.”

Parents are expected to contribute to living costs

Martin pointed out that a student’s living loan will be based on their parents’ residual income with some minor adjustments on pension contributions and additional children. He noted that an income of around £65,000 will result in a minimal living loan in England which is about half of the maximum.

He added that while it is never explicitly stated, it is implied in the system that parents will help fund their children’s living costs. Instead, he advises parents to calculate what they may contribute to their children’s living costs and put some aside so they’re better prepared for when their child goes to university.