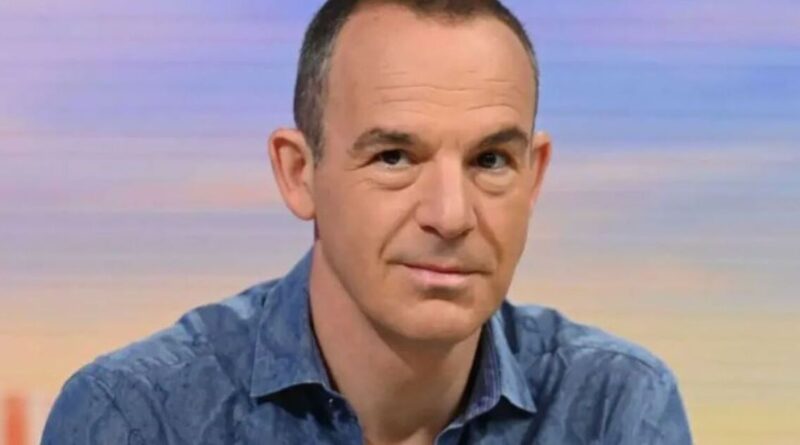

Martin Lewis warning to UK households with £10k or more in savings accounts | Personal Finance | Finance

Martin Lewis has warned people could face tax bills if they have more than £10,000 in savings accounts. On his BBC Podcast, the MoneySavingExpert founder explained that it’s not the savings themselves that are taxed, but rather the interest they generate. He added that for people in their 20s and 30s, bypassing traditional savings accounts might be the smartest move under certain circumstances.

Martin said: “The more you earn and the more savings you have, the more likely you are to be taxed on your interest. If you are a basic rate taxpayer – a 20% rate taxpayer, you are allowed to earn £1,000 of interest in all savings accounts tax free. Above £1,000 interest it is taxed. If you are a higher rate 40% taxpayer you’re allowed to earn £500 interest tax free.

This means a person on the higher rate would need to have £10,000 in savings in the highest rate savings account before being taxed.

Individuals earning over £125,000 don’t receive a tax-free savings allowance. Martin added that as long as people make smart decisions, they will avoid tax on savings.

This can be achieved by using accounts like cash ISAs which offer tax protection, where individuals can deposit up to £20,000 a year.

He explained: “You don’t pay tax on savings, it’s the interest you earn on savings that are taxable. But most people won’t earn enough interest because there are allowances that you’re allowed to use, so you won’t pay tax.

“The most important one for taxpayers to know about is the personal savings allowance, which means for a basic 20% rate taxpayer, you can earn £1,000 a year of interest from any source, any savings, you won’t pay tax on it.

“Higher 40% rate taxpayers get £500 a year tax free. Top 45% rate taxpayers don’t get a personal savings allowance.

“But think about this for a second. If you put the money in the top easy access account at the moment that pays 5% interest, you would need £20,000 in it to generate £1,000 of interest.

“So it’s only as a basic rate taxpayer, if you have over £20,000 saved that you may be paying tax.”

This suggests that someone paying 40% tax would need £10,000 in the highest-paying savings account to breach the tax threshold.

Martin clarified: “But as well as your personal savings allowance, you’re also allowed to save £20,000 a year into a cash ISA. Now a cash ISA is just a savings account where the interest is never taxed and it doesn’t count to your £1,000 a year, so it’s an extra allowance on top.

“You can put £20,000 in per tax year and the top payers of that are paying 4.76% at the moment, Easy access, so you can even take your money out when you want to.

“So with a combination of the personal savings allowance and cash ISAs, the vast majority of people don’t need to be paying tax on their savings.”

Chancellor Rachel Reeves has decided not to move forward with reported plans to cut the annual cash ISA limit from £20,000 to £4,000. The proposal was said to be aimed at encouraging people to invest in UK businesses rather than leave their money in savings accounts.