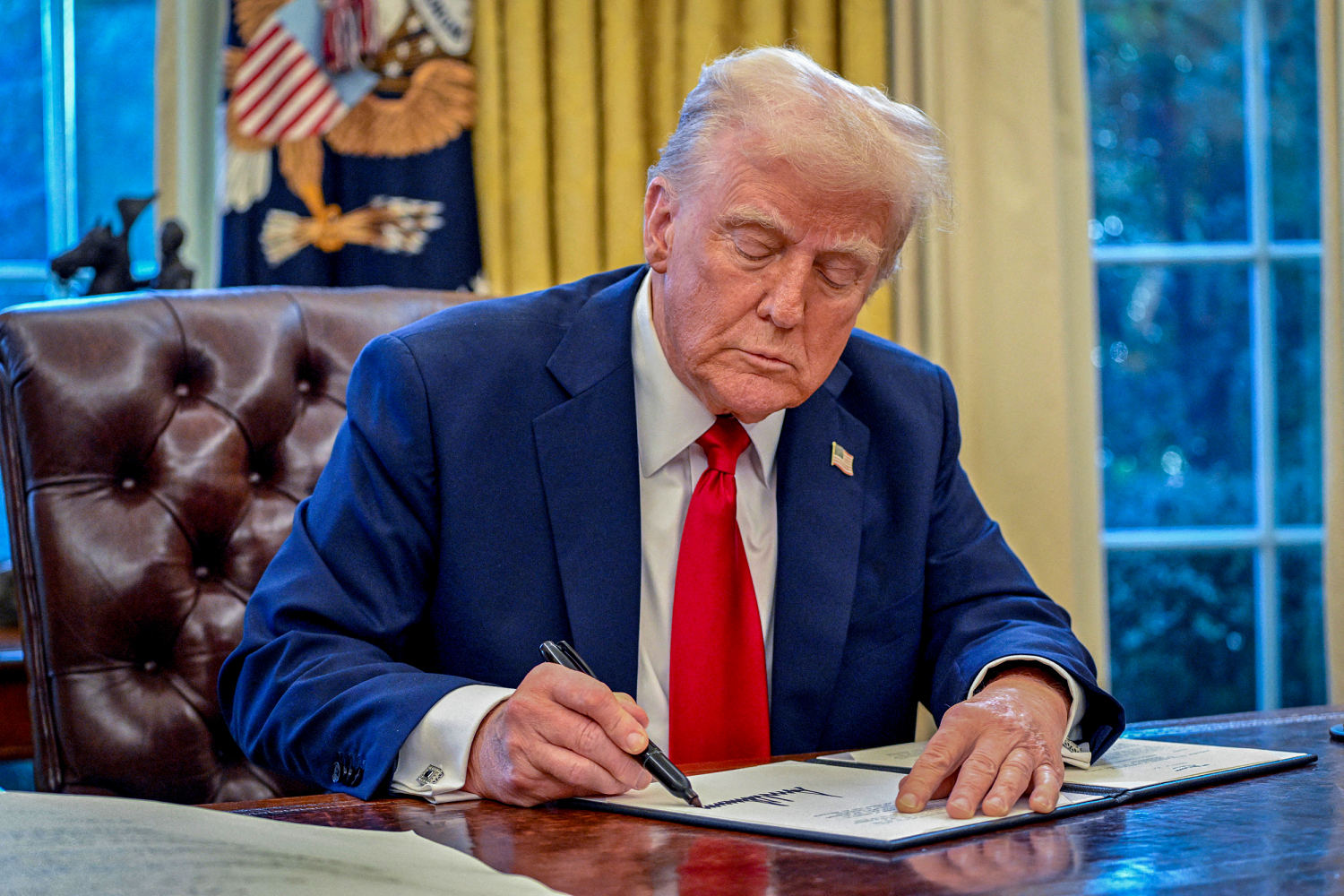

Trump signs order imposing 25% steel and aluminum tariffs

President Donald Trump signed an order Monday that imposes a 25% tariff on all steel and aluminum imports to the United States.

“This is a big deal,” Trump said while signing the order in the Oval Office. “The beginning of making America rich again.”

The tariffs come just a week after Trump promised to suspend tariffs on Canada and Mexico. They echo steel and aluminum tariffs Trump imposed during his first administration, though at that point those were imposed explicitly on national security grounds.

This time, the rationale for the tariffs is somewhat more ambiguous: Trump has cited creating jobs and narrowing the U.S. trade deficit. Over the weekend, the president promised to punish countries “taking advantage of” U.S. businesses.

Many analysts see the tariffs as a negotiating tool to extract concessions from other nations.

Most of the steel used by American firms is already domestically produced, according to a 2022 Congressional Research Service report — though the percentage of aluminum imports used by U.S. firms is much larger.

Some American firms are still coming out against the use of tariffs. On Monday, the United Steelworkers Union, a group ostensibly designed to benefit from tariffs, said the measure would backfire if applied too broadly.

“We must distinguish between trusted trade partners, like Canada, and those who are seeking to undercut our industries as they work to dominate the global market,” it said in a statement.

Canada is the largest supplier of steel to the U.S., followed by Brazil, Mexico, South Korea and Vietnam.

Trump has floated the idea of reciprocal, tit-for-tat tariffs. According to analysts with the Capital Economics consultancy, such a scenario would, in essence, see Trump taking a more “measured” approach to trade negotiations if the threat of an across-the-board tariff is eliminated.

Still, “given Trump’s penchant to act first and negotiate later, it still seems likely that tariffs will push up inflation this year and that the Fed will remain on hold as a result,” they wrote in a note to clients, referring to the expected trajectory of interest rates.